We are here to assist you with the detailed steps to set up the direct deposit in QuickBooks for the employees. Further we will discuss what it is and how does it work? Stay tuned till the end!!

What is Direct Deposit in Quickbooks?

To understand, direct deposit is an electronic or digital method of transferring the funds from one account to another. Using the Direct Deposit feature of the Quickbooks, you can pay directly to your employees from the employer’s bank account. This is a hassle free process of funds transfer for both employer and employee.

You can use direct deposit under various scenarios discussed here:

Employee Pay:

Direct Deposit is used by most of the employers for fund transfers to their employees. With this feature, it has become very convenient and also it has reduced the cost of funds transfer to their employees. For Employees, once you have cleared ACH , payday is fun!

Tax Refunds:

The US government prefers paying the direct deposit directly to their citizens since it is more secure and is more streamlined for both the parties. You will get the tax refunds directly as the direct deposits. You can set up the Direct deposit using the IRS, if it is not yet set up.

Stimulus Checks:

As per the CARES act, in 2020, the US government distributed the emergency assistance stimulus checks. The citizens received the checks, who already opted for the IRS direct deposit program. These checks are directly credited to the bank account on their tax return.

How Does Direct Deposit Function?

Using it, the employee can transfer the paycheck with the help of employees’ information. On the payday, the funds are credited to your financial institution and it takes 2 working days to reflect in the account. Digital transfers are very convenient and beneficial for both parties.

Read Also: How to Resolve the Login Problem of QuickBooks Online on Chrome

How to set up the Direct Deposit for Employees?

For setting the direct deposit for employees, you should first set up the company payroll for direct deposit, then you need to add the direct deposit for employees after getting the authorization form and that’s it!! Here are the steps that are to be followed:

Way 1: Setting up the company payroll for Direct Deposit

- Let us look into the steps for setting up the company payroll for direct deposit.

- The first task is to get the complete information of your business, principal offer, and bank.

- Also keep the business name , EIN and address handy.

- Keep principal officer security number, home address and date of birth available.

- Bank login details, and account number should be handy.

- Now, you need to connect with your bank.

- Open QuickBooks and login to the Quickbooks.

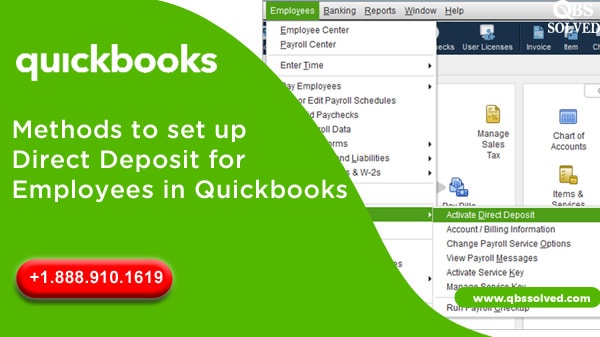

- Reach the employee menu.

- Move to the My payroll Service option.

- Choose the Activate Direct deposit.

- Move to get started and if you do not see this option, then:

- Click on I’m Admin followed by choosing I’m the primary person who …………..

- Enter the email address of the admin.

- Select on continue to proceed.

- Enter the email and user ID and password.

- Click on Get Started.

- Now, in the business tab, go to the start button and provide the required information.

- Click Next.

- You have to mention the principal information and click Next.

- Add a new bank account.

- Next, you have to enter the bank name and if it asks for the account number, provide it.

- Create a PIN that would be used every time to send the payment or payroll.

- Click Submit and then Next.

- If asked, you must confirm the principal officer’s full social security number.

- You will see the message-

- Thank you for signing up for the QuickBooks Direct Deposit. What is next to activate Direct Deposit? That means there are a few more steps to connect the bank account.

- Now, your bank account is connected. This means you are ready to pay your employees by direct deposit right away.

- You need to verify the bank account in Quickbooks.

- You should check with the bank account in 2 working days and you need to check that by debiting a small amount less than one dollar from the QuickBooks payroll.

- If you are able to see the amount, then open the QuickBooks and login to it.

- Move to the employees tab and then My payroll service.

- Click on Activate direct Deposit.

- Sign in to the Intuit account using your details.

- You have to enter the debit amount twice and then you need to click on verify.

- You can enter the Payroll PIN and click the submit.

Read Also: How can QuickBooks Database Server Manager be installed and used?

Way 2: Getting Direct Deposit Authorization.

You can get the direct deposit authorization form and then you can get the voided check from the employee’s bank account. These things are for records only and you don’t need to submit it into the Quickbooks. This helps to keep the records of the employees.

Way 3: Adding Direct Deposit to the Employees.

If the employee bank asks for the account to be tagged as a money market then you should inform the employee. You need to inform them that the quickbooks only accept savings and checking the accounts.

- Go to the employees menu in Quickbooks.

- From the Drop down, move to the option Employee centre.

- Choose the employee from the employee list.

- Move to the payroll info tab.

- Go to the press Button Direct Deposit and then you will see the windows of direct deposit.

- Choose the Deposit paycheck into one or two accounts.

- Next, you have to provide the financial institution of the employees.

- Click ok and then save the information.

- Enter the PIN of direct deposit when asked in order to make the payroll.

Direct Deposit for Employees in Quickbooks- Benefits

Employees get many benefits that an employee gets in direct deposit. Here are some of the benefits are discussed:

Simplified Budgeting:

Direct deposit is the best automated solution that helps in building up the savings account. Once the direct deposit starts, you can request some amount of paycheck to be deposited directly into the account.

No Paperwork

Say goodbye to the paperwork once you switch to the direct deposit.All the deposits and payments are recorded electronically or digitally and pay stubs are not required to be recorded.

Convenience:

For depositing the paycheck, you are no longer required to visit the bank and wait in queue making direct deposit much convenient. The transaction gets completed through communication between the financial institution and the payer.

Eco-Friendliness

Since there are no papers used and papers and all the things are done digitally. So it is always a great choice to switch to direct deposit.

Information provided by Employees for direct deposit:

- Bank Name

- Bank Account number

- Account type in the Bank

- Bank routing number

- You are also required to sign an authorization form to allow the employer to transfer the funds.

Benefits Employers get after setting up the Direct Deposit for Employees:

- Increased security.

- Saves money as there would be no mail checks and prints.

- Automated pay scheduling won’t be missed.

- Saves time

You can use any of the methods discussed here. If you have any questions regarding the update of the Quickbooks, get in touch with experts QBS Solved at +1(888) 910 1619.

How to Resolve the Login Problem of QuickBooks Online on Chrome