We often wonder what is bad debt in QuickBooks? It means that a customer owes you money but you know that you are never going to get paid. The debt remains constant. If you use the accrual accounting method for your business, then you can write off bad debt as a deduction. When the invoices sent by you become uncollectible, you can write them as bad debt. This helps in ensuring your receivable account with an up-to-date net income.

How to Write off bad debt in QuickBooks

Here are a few methods that you can use to write off bad debt in QuickBooks. Make sure you follow all the points properly and in case you face any issues get in touch with the professionals

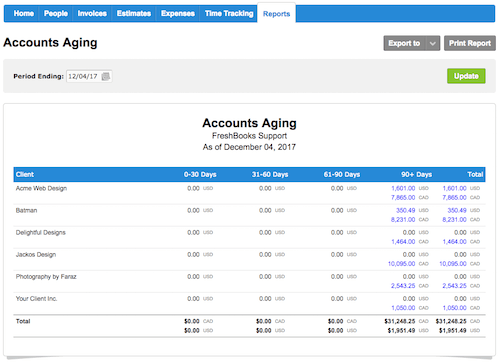

Method 1: Take a quick look at your ageing accounts receivable

Check remaining invoices or receivables that should be considered bad debt using the Accounts Receivable Ageing Detail report.

- Navigate to Reports.

- Search and open the Accounts Receivable Ageing Detail report.

- Select the outstanding accounts receivable which should be written off.

Read More: Fix QuickBooks Code 6073 (Unable to Open Company File)

Method 2: Create a new account for bad debts expense

If you don’t have a “bad debts” expense account. Then you must create a new independent account.

- Go to Settings and click on the Chart of accounts.

- At the top right corner, select “New” to create a new account.

- Now click on ‘Account Type‘ a dropdown will display, select Expenses now.

- From the ‘Detail Type‘ choose the ‘Bad debts’ option.

- Now finally click on ‘Save‘ and close.

Read More: Read the Full blog and Fix QuickBooks Error 6190,816

Method 3: Create a bad debt item

The user needs to create a non-stock item to act as a placeholder for the bad debt.

- Click on ‘Settings’ and go to ‘Products and Services’.

- Now click on ‘New’, and then hit ‘non-stock’.

- Go to the Name field, and enter “Bad debts.”

- Now select ‘Bad debts from the Income account dropdown, select Bad debts.

- Select Save and Close.

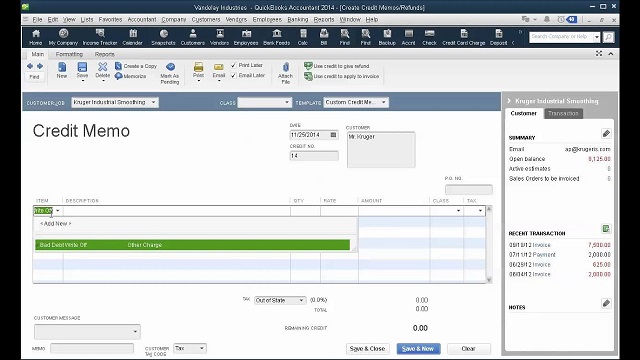

Method 4: A credit note for bad debt

- Click on Select then, New.

- Hit on ‘Credit note’.

- Choose the customer from the customer dropdown.

- Go to the Service section, and choose Bad debts.

- Go to the Amount column and enter the amount you want to write off.

- Go to the ‘Message display’ on the statement box, and type “Bad Debt.”

- In the end, you just need to Save and Close.

Method 5: Application of credit note to the invoice

- Hit on Select + New.

- Go to ‘Customers’, and click Receive Payment.

- From the ‘Customer dropdown’, choose the appropriate customer.

- Go to the ‘Outstanding Transactions section’, and click on ‘select’ the invoice.

- Now select the credit note from the Credits section.

- Finally Select Save and Close.

The uncollectible receivable will be displayed on the screen on the profit and loss report under the Bad Debts expense account.

Read More: How to Resolve QuickBooks Crash com Error

Method 6: Launch a bad debts report to write off bad debt in QuickBooks

- Select ‘settings’ and hit ‘Chart of accounts’.

- Go to the Action column of the bad debts account, and select Run report.

You can also segregate a bad-debt entity apart from other customers by following the steps and adding a note to their name:

- You need to go to ‘Sales‘ and select ‘Customers‘.

- Click on the customer’s name.

- Go to the top right corner, tap on Edit.

- Click on ‘Display Name as field’, and type “Bad Debt” or “No Credit” after the customer’s name.

- Hit on Save.

Now that you have come across all the methods to write off bad debt in QuickBooks, it will be convenient for you to acquire the desired result. In case you face any technical glitch or any issue that seems beyond comprehension then you must QBS Solution is always there to assist you. You can reach out to us on the official website or our toll-free number 888-910-1619.

Read More: Fix QuickBooks Error 80070057 (The Parameter is Incorrect)