Have you encountered any negative inventory issues in QuickBooks desktop? In the article we will help you in fixing negative inventory issues with step by step process.

What is Negative Inventory?

Negative inventory issues in QuickBooks are encountered if you enter the sales transaction before you enter the corresponding purchase transactions. In brief, you are selling the inventory items that are not in stock with you.

If you sell Inventories that are entered in the company file:

- You are using the Items tab on an item receipt, invoice, check or credit card translation, debit entry of an item, credit the A/P cash or credit card payable to purchase items.

- You are not selling items on invoices or on sale receipts.

- The sale transaction helpful in registering sales/receivables transaction, debit A/R transaction, credit salesIt also register the inventory/COGS transaction, credit inventory and debit is COGS.

- Running P&L and expense reports that show invoices and sales receipt as they record both income and expense.

- Running B/S reports that show item receipts, invoices, check and credit card as they show increase in inventory and show invoices and sale receipts as they record the reduction in inventory.

Also Read: How to Get QuickBooks Error 1321 Fixed

Selling item that are not entered in the company file:

- Invoice helps in recording the sales/receivable transaction as expected.

- Talking about inventory/COGS transactions, QuickBooks considers the average cost of the items not on hand, it must be equal to the items that are there on the items cost from the Item list.

- QuickBooks record all the inventory and COGS transactions through assumed cost.

- If the upcoming transaction is not on the assumed cost of QuickBooks, then the purchase transaction must be registered to an adjustment to inventory and CGS to adjust the appropriate difference.

- Since the bill is affecting the COGS, it shows on P&L, and other reports that show expenses.

How can negative inventory be identified?

Negative inventory can come up on the balance sheet, but mostly is shows on the following reports:

- Inventory Valuation Detail (IVD) report.

- Negative Item Listing Report

Inventory Valuation Detail (IVD) report:

- IVD report is used to evaluate the level of negative inventory. In the column Quantity on Hand, the negative number shows the negative inventory.

- You should open the report menu.

- Choose inventory and then select inventory evaluation.

Also Read: How to Resolve QuickBooks Error 6000, 95

Negative Item Listing Report:

- Negative Item Listing Report can be used in the QuickBooks enterprise 15.0 and later versions. This report is used to show the current negative quantities and past negative quantities are not shown.

- Open the Report Menu.

- From the inventory option choose Negative item Listing.

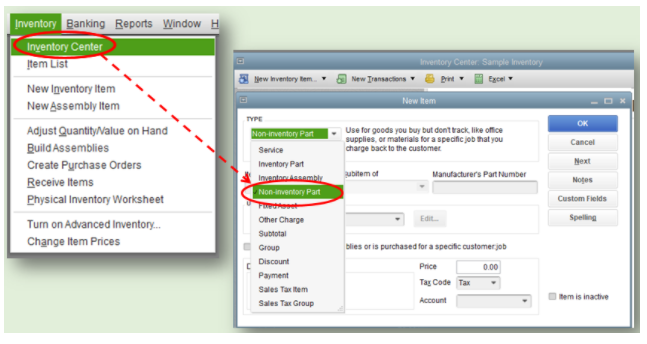

- For QuickBooks premier and Enterprise 2014, that does not have the Advanced inventory, can use the inventory center as follows:

- Open the vendors menu followed by selecting Inventory activities.

- Next, select the inventory center option.

- From the inventory center window, select the filter from the active inventory to assemble yo QOH<=ZERO.

What are the issues due to negative Inventory?

- There is no average cost for new inventory.

- If the initial QOH/VOH are not mentioned while creating a new inventory item with Item cost, then the item will not have average cost.

- Sales can put the item in the negative inventory.

- The invoices without any average cost to credit inventory and debit COGS. use the item list for the item cost.

- The item that is purchased for a cost that is not the same as the item cost.

- The bill has an adjustment to inventory and COGS for the difference in the item cost and real purchase cost and this results to show on the P&L report.

- The first transaction that was displayed was an invoice and not a bill, check or credit transaction.

- If you are selling the inventory that is not available it drives your quantity on hand (QOH) negative and this causes incorrect cost of the goods sold on the P&L report.

- A new inventory is included without an item cost.

- Without purchasing any unit, you sell the inventory item.

- QuickBooks has no information on average cost, so it uses the average cost $0.00.

- This distorts the COGS and inventory.

- The issue might not get fixed, till you establish an average cost with a bill, check or credit card change or adjust Qty/Value on hand.

Also Read: How to Resolve QuickBooks Error 4120

Negative Inventory results in Error on the vendor reports

You might usually find the inventory/ COGS transaction on the invoice. If out of stock items are being sold, it might result in the next bill to contain an adjusting inventory/COGS translation. These adjustments are related to the vendor and are shown in the vendor reports.

Troubleshooting Negative Inventory in QuickBooks Enterprise:

Before performing the troubleshooting make sure that you create backup of the company files. Make sure that changes are legitimate and there is insufficient to bring the current QOH to positive value.

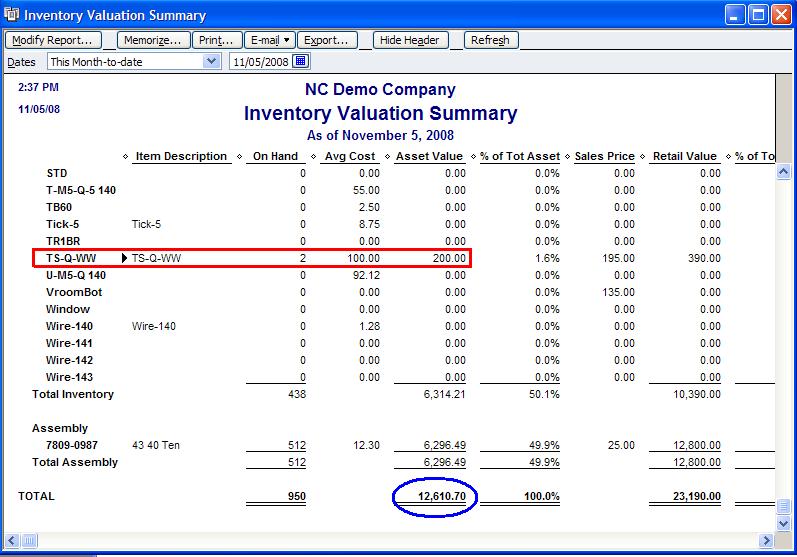

If the sales are first transaction for an item:

- Reach the QuickBooks reports option.

- Choose the inventory and then inventory valuation summary.

- You should Quickzoom the item with the correct values by double-clicking on the item name and you will see the inventory valuation detail report for the item.

- You need to Quickzoom the first bill on the list and it will open the Enter bills window.

- Make the relevant changes to the date on the bill to a date in the first invoice listed on the detail report.

- Save it and close it and then follow these steps for each incorrect item.

Also Read: How to resolve QuickBooks error 1402

If the sale is for the item that does not have purchase records:

- You might have entered the bills with accounts and you have forgotten the inventory items.

- In this case you need to edit or change the entries from the expenses tab to the item tab.

- These steps might also alter the inventory expenses.

If purchase were entered before entering the sales:

- You can legitimately fiddle with the transaction dates with the date before the invoice.

- Choose Reports from the menu option.

- Choose inventory followed by selecting Inventory valuation Detail.

- You need to go to the dates drop-down and select All.

- You need to choose the report to an item displaying a negative amount in the On hand column.

- Repeat these steps for all the negative amounts that you see in the On Hand Column.

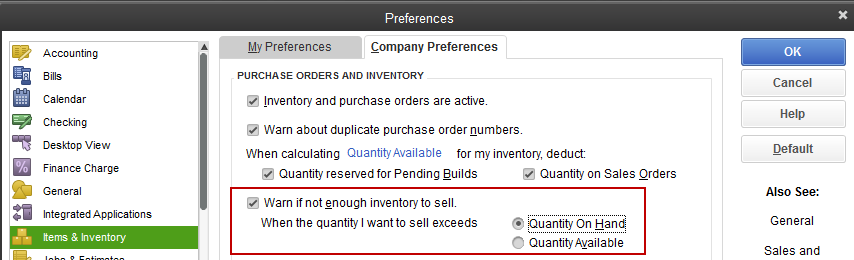

How to avoid Negative Inventory issues?

- To ensure that this issue does not repeatedly occur, you should not sell the inventory items before you have them.

- Setup Inventory Item with opening balance

- You should create a fresh inventory item and enter the necessary information.

- You must enter the QOH and value at the bottom so as to establish an average cost.

- If there are no units on hand, you should purchase before entering a sale.

Estimating Sales for the inventory you lack:

- You should enter the customer order in the place of sales.

- You must enter the customer order as invoice and mark the invoice and pending by selecting the edit options and then selecting mark invoice as pending.

- After purchasing the inventory item, you must enter the purchase in the company data file.

- You must convert the sales order to an invoice.

Utilizing the invoices to enter sales that are not there in inventory:

- You can use the customer order as an invoice.

- From the edit option you should select the mark invoice as pending.

- You must enter the purchased inventory item in the company data file.

I am positive the QuickBooks inventory issue is now resolved. If the issue still persists, feel free to connect with QuickBooks Support QBS Solved at +1(888) 910 1619.